Trust Foundations: Ensuring Resilience and Integrity

Trust Foundations: Ensuring Resilience and Integrity

Blog Article

Guarding Your Assets: Trust Foundation Expertise at Your Fingertips

In today's complex monetary landscape, ensuring the security and growth of your properties is extremely important. Depend on structures work as a keystone for securing your riches and legacy, providing an organized method to asset security. Competence in this world can offer vital assistance on navigating lawful intricacies, optimizing tax obligation performances, and developing a robust monetary plan customized to your unique demands. By taking advantage of this specialized understanding, people can not just protect their properties properly however also lay a strong structure for lasting wealth conservation. As we discover the details of depend on foundation experience, a world of opportunities unravels for fortifying your monetary future.

Importance of Count On Foundations

Trust fund structures play a critical function in developing credibility and cultivating solid partnerships in different expert settings. Depend on structures serve as the cornerstone for ethical decision-making and transparent communication within organizations.

Advantages of Expert Advice

Building on the structure of rely on expert connections, looking for specialist support supplies very useful advantages for people and organizations alike. Expert guidance offers a wide range of knowledge and experience that can assist browse complex financial, legal, or critical difficulties easily. By leveraging the competence of specialists in different fields, people and companies can make enlightened choices that straighten with their objectives and goals.

One considerable advantage of specialist advice is the capacity to access specialized understanding that may not be conveniently offered otherwise. Experts can supply insights and viewpoints that can result in ingenious services and opportunities for development. In addition, dealing with experts can aid alleviate risks and unpredictabilities by providing a clear roadmap for success.

Moreover, professional advice can conserve time and sources by improving procedures and staying clear of expensive mistakes. trust foundations. Specialists can provide customized recommendations customized to details requirements, guaranteeing that every decision is well-informed and critical. On the whole, the benefits of professional assistance are complex, making it a beneficial property in safeguarding and taking full advantage of properties for the long term

Ensuring Financial Security

Guaranteeing monetary security involves a complex approach that includes different aspects of wide range monitoring. By spreading out financial investments across various asset classes, such as stocks, bonds, actual estate, and assets, the threat of considerable financial loss can be minimized.

Furthermore, keeping an emergency fund is important to guard against unanticipated expenses or revenue disruptions. Experts advise setting aside 3 to 6 months' well worth of living costs in a fluid, easily accessible account. This fund functions as a monetary safeguard, supplying satisfaction throughout stormy times.

Routinely evaluating and changing economic plans in reaction to altering conditions is also paramount. Life occasions, market fluctuations, and legal modifications can affect economic security, emphasizing the significance of recurring evaluation and adjustment in the quest of long-term financial security - trust foundations. By applying these techniques attentively and consistently, individuals can fortify their financial footing and job towards an extra safe future

Protecting Your Properties Successfully

With a solid foundation in location for monetary safety and security with diversity and emergency situation fund maintenance, the following important action is protecting your possessions successfully. One effective approach is asset allotment, which entails spreading your financial investments throughout numerous possession courses to lower risk.

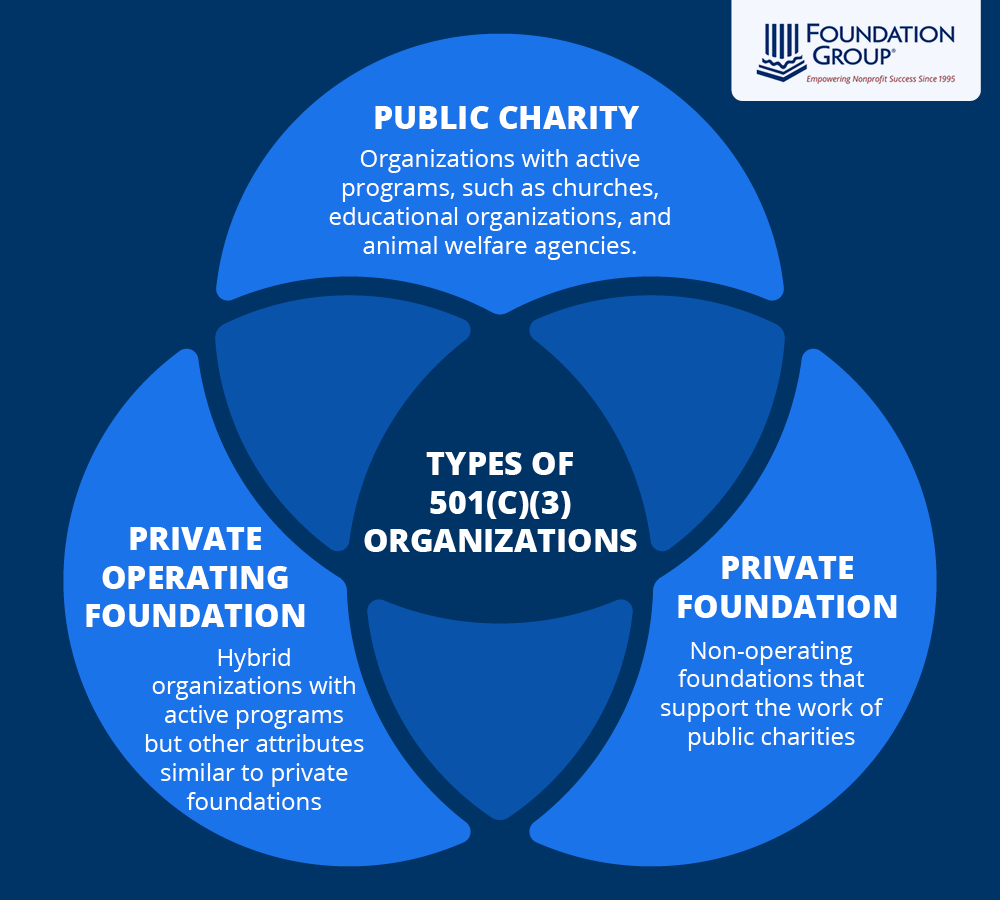

Furthermore, developing a count on can use a secure method to protect your possessions for future generations. Counts on can assist you manage exactly how your possessions are distributed, lessen inheritance tax, and protect your riches from creditors. By applying these techniques and looking for specialist advice, you can safeguard your possessions successfully and safeguard your financial future.

Long-Term Possession Defense

Long-lasting asset security involves implementing actions to safeguard your assets from numerous dangers such as financial slumps, claims, or unexpected life occasions. One vital facet of lasting asset protection is establishing site a trust, which can offer significant benefits in shielding your properties from financial institutions and lawful conflicts.

Additionally, expanding your financial investment profile is an additional vital approach for lasting possession security. By spreading your investments throughout various possession classes, sectors, and geographical regions, you can lower the effect of market fluctuations on your total wealth. In addition, on a regular basis examining and upgrading your estate plan is essential to ensure that your properties are shielded according to your wishes over time. By taking a proactive technique to lasting possession security, you can safeguard your wealth and give monetary security for on your own and future generations.

Conclusion

In verdict, count on structures play a vital role in securing properties and making why not try this out certain financial safety. Professional assistance in developing and managing depend on frameworks is important for long-term asset defense. By making click reference use of the competence of experts in this area, individuals can effectively safeguard their properties and prepare for the future with confidence. Trust structures give a strong framework for protecting riches and passing it on to future generations.

Report this page